From Stove Fire to Full Property Claim: Understanding the True Cost of Smoke and Soot Damage

A kitchen fire might seem like a small incident—but the smoke, soot, and chemical damage can affect every room in your home. Learn why fire marshal reports, hygienist testing, and public adjusters are essential after even the smallest blaze.

8 Things to Look For in Your Homeowners Insurance Policy

Most homeowners only learn what their insurance doesn't cover after it's too late. Don’t wait for a denied claim to discover your policy’s weak spots. This guide explains 8 critical policy elements every Florida homeowner should review before disaster strikes—from appraisal clauses to roof replacement cost coverage.

10 “Did You Know?” Facts About Property Insurance Claims That Could Save You Thousands

Don’t let insurance policy fine print cost you thousands. Discover 10 surprising facts that can impact your claim—and how VIP Adjusting can help you recover what you’re truly owed.

What to Consider When Buying a Property with an Open Insurance Claim

When buying a property with an ongoing insurance claim, understanding the claim’s impact is crucial. From Assignment of Benefits (AOB) transfers to securing new insurance, VIP Adjusting helps you navigate the complexities, ensuring the claim is fairly adjusted and your investment is fully protected. Let us guide you through the process and maximize your claim settlement.

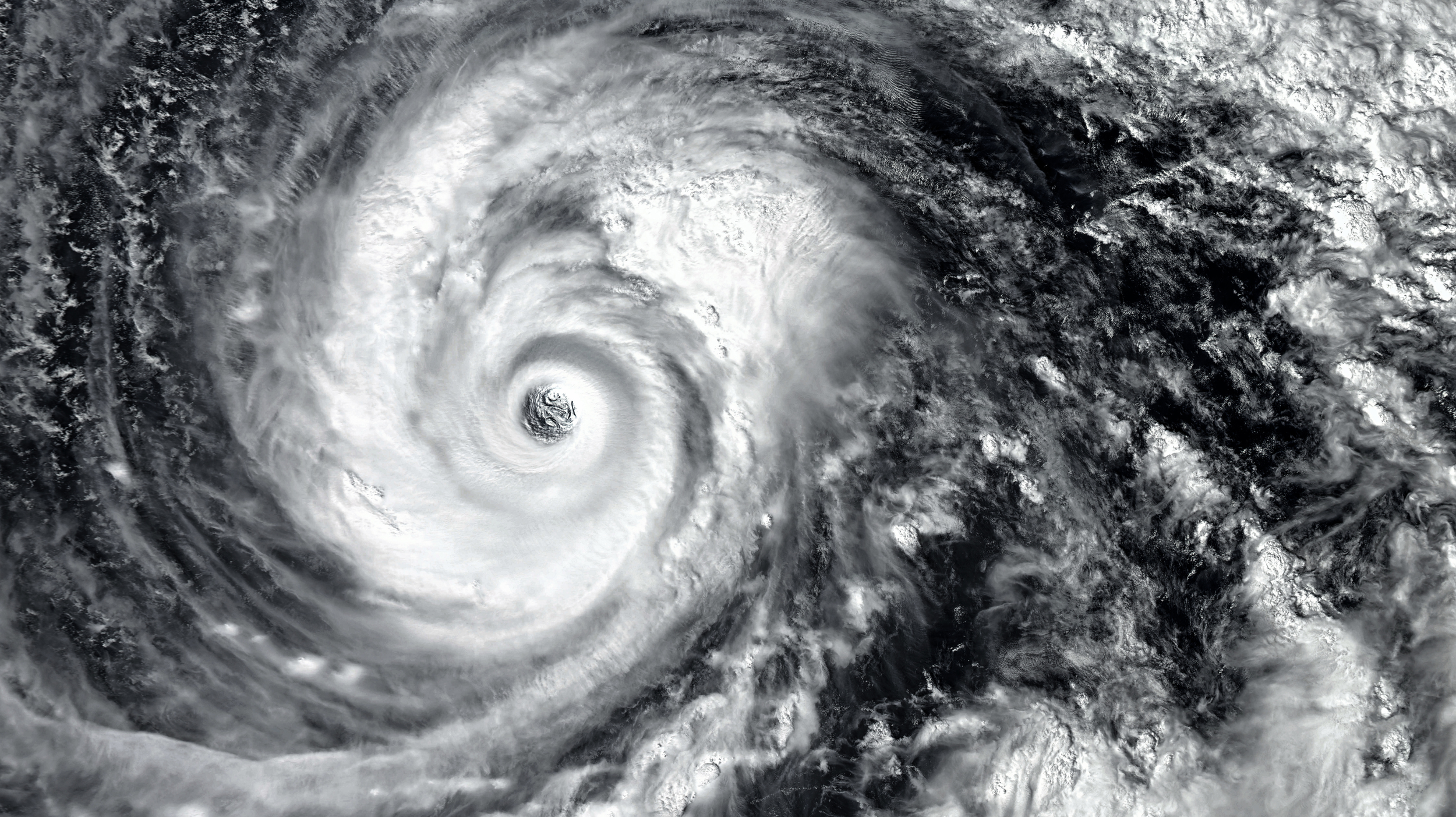

Hurricane Debby Update: Navigating the Aftermath and Preparing for the Next Steps

On Monday, August 5th, Hurricane Debby made landfall in Steinhatchee, Florida, as a Category 1 hurricane with maximum sustained winds of 80 mph. The storm brought heavy rain, high winds, and significant flooding to many parts of Florida, causing widespread damage and prompting numerous rescue operations.

Anti-Public Adjuster Endorsements: What Policyholders Need to Know

Discover the hidden clauses in your insurance policy that could limit your rights. Our latest blog post shines a light on the anti-public adjuster endorsement. Learn how these endorsements work, their implications, and how we can help. Don't let complex language stand in the way of your protection. Read more about your rights and how to ensure you're fully covered.