10 Common Reasons Homeowners Insurance Claims Are Denied - How to Fight Back

Denied Homeowner Insurance Claim or Underpaid? Here’s what your homeowners insurance company doesn’t want you to know and how a Public Adjuster can help you recover!

Top 10 Reasons Insurance Claims Are Denied or Underpaid

“No Storm-Created Opening” Denial

“Pre-Existing Damage” Excuse

“Late Reporting” Rejection

“Wear and Tear” or “Maintenance” Exclusions

Emergency Mitigation Cap (EMS Cap) Misuse

Mold Exclusion Misunderstanding

Flood vs. Water Damage Confusion

Matching Clause Ignored

“Non-Cooperation” Claim Denials

Lowball Estimates & Over-Depreciation

Intro: You did Evertything Right, so why the denied homeowners claim?

You followed the rules. You paid your homeowners insurance premiums. You filed your insurance claim after discovering property damage. Then out of nowhere a denied insurance claim letter hits your mailbox, or just as ludicrous, you receive a laughably low payout along with a woefully inadequate estimate of damages.

If this sounds familiar, you’re not alone. As Public Adjusters at VIP Adjusting, we hear this story almost daily. The truth is, insurance companies count on most homeowners not understanding the fine print. Insurance companies use this to their advantage.

That is until today. After you read this article, you’ll be aware of their tricks and tactics to delay, deny or underpay your homeowners or business insurance claim. We will break down the 10 most common reasons homeowners claims are denied and what you can do about it.

Read the following link for more information if your claim was denied: What to do when your insurance company denies your homeowners insurance claim

REASON #1: NO STORM CREATED OPENING DENIAL

One of the most abused excuses in states like Florida, South Carolina, and Texas (which are storm-prone states), Insurers often claim that water entered the dwelling without a “storm created opening” in the roof, window or exterior wall.

Why they do it: It allows them to deny interior water damage even if you had a legitimate loss. It’s their opinion against yours. By inspecting the property and issuing a denial letter, the insurance company is basically satisfying their requirement by law to investigate and respond to the claim. Even in the face of obvious damage (see photo below of an actual Hurricane claim), we have seen the carrier deny a claim due to “No Storm Created Opening Observed”. Your opinion was that “this damage was caused by a damaged roof”. Their opinion could be “this damage was caused by wind blowing water through ridge vents (normal openings in soffit for ventilation)”. Wind driven rain through existing holes such as soffit are not classified as storm created openings, as such, the insurance company exercises their liberty to deny the claim.

How they do it: Let’s take a look at a real world example. We have represented many of the individual unit condo owners against various insurance companies that live in the building from the picture below. The building was severely damaged by Hurricane Milton. When the Insurance Company Representative (usually a field adjuster or independent adjuster) came to inspect , they refused to go up on the roof to observe roof damage. Even upon being encouraged to do so, with easy access via stairs and a door (no ladder needed), they refused. Instead, they often stated they don’t have time and they are doing 15 inspections a day. They proceed into the condo, took a handful of photos and left. Often times, they don’t even measure the floor plan because they grabbed it from publicly available floorplans from various sources. Therefore, they submit their report to the desk adjuster, conveniently missing photos that would normally show a source of water intrusion, even though the condo was obviously damaged. This of course gives the Desk Adjuster at the insurance company an opening to deny the insurance claim. Disclaimer: We are not insinuating that all insurance companies practice this sort of protocol when inspecting damage, however we have seen it on many occasions.

What to do about it: A Public Adjuster can inspect your roof damage, obtain experts such as engineers, roofers, contractors, and document storm created openings that trigger coverage. For the property below, we at VIP Adjusting, flew drones and photographed the roof. We physically went up on the roof and took close up photos of AC units that were knocked over, damaging pipe penetrations through the roof, exposed roofing tears, etc. We pre-emptively submitted these to the insurance company before the inspection, during and after because we know their tactics. Even with information in hand, the carrier attempted to deny the claims based upon “No Storm Created Openings”. They conveniently tried to state that the holes shown were not directly above the unit owner’s in question. They conveniently failed to understand that the roof is one unit that covers ALL units, and that one breach can be a massive water source for any and all units. We demonstrated many different Storm Created Openings in numerous locations and fought back with irrefutable evidence. After fighting back and forth over many months, we successfully won all arguments and were able to fully indemnify (pay) the insureds (homeowners) on the insurance claims.

If you are fighting a homeowners insurance claim on your own, or you currently have a Public Adjuster, be sure to provide damage documentation that is irrefutable, clear, cut and concise. Even then, expect massive pushback, misunderstanding, convenient responses such as “I just took over this claim, I’ll need a few weeks to catch up” or an ignoring of correspondences altogether. If you don’t have professional help, call VIP Adjusting now at 833-WITH-VIP (833-948-4847) or reach out to us via the following link for more information Contact Us Here

Read more about Roof Leak Insurance Claims in Florida

Hurricane Milton Damage: St Petersburg Fl

There is a big gaping hole in the vertical exterior wall of this building and the roof has been obviously breached from Hurricane winds.

This is one of a dozen condominium buildings with similar damage. The Insurance company denied many of the condo owners insurance claims citing “No Storm Created Opening”.

Luckily, we were working on these cases at VIP Adjusting and successfully got every insured paid in full!

REASON #2: PRE-EXISTING DAMAGE

Insurers love to say your property damage was there before the covered peril. That warped baseboard? “Old". Over there, that cracked tile? “Pre-Existing”.

Why they do it: It shifts the burden upon the homeowner to prove when the damage occurred. If you present damages to the insurance company, and they determine that the property damage is old, what then? What do you do from there. It’s a win for the insurance company in that they can deny the claim or at least delay the claim. For the folks that give up in face of an insurance claim denial, the carrier wins. For folks that keep on fighting forward, the carrier still wins in a minor way because of the delay. However, the win will be short lived if you press forward and produce information that proves the damage was not pre-existing such as an inspection report from a recent home purchase or photos of the subject item from a recent event. It takes time to work through that process, and it falls into the carrier’s play book. By delaying a claim as long as possible, homeowners are willing to accept less money as time goes on because their resolve and energy to see it through wavers. With a licensed Public Adjuster, we know how to push back and what information to provide as leverage to overturn the claim denial. The insurance company may win the battle, but if you have good representation, they’ll lose the war. Keep in mind, ethically, insurance claims are not meant to be confrontational or adversarial, however with the many different characters at play, and with fraudulent denials, it’s hard to remain non confrontational. Rely on a Public Adjuster to systematically work your insurance claim in a professional manner.

How they do it: The insurance company field representative may take photos or document the file in a way to suggest the damage couldn’t possibly be recent, that it was months or years old. We’ve seen an insurance company claim that hail damage to an existing roof couldn’t possibly be from hail because that same hail storm did not rip through the screened ceiling of an attached pool enclosure. They claim the hail was pre-existing damage to the recent hailstorm even though the insured had a video of the hail raining down golf ball sized ice balls. If the insurance company doesn’t see the actual hail hit the actual roof and create the actual damage, all sorts of “opinions” can be made.

Hail

With Hail this size, how can an insurance company possibly claim it didn’t damage the roof?

What to do about it: It takes perseverance, commitment, a non-stop action to escalate the claim to a managing director at the insurance company to listen to reason. Even then, there is no guarantee of claim resolution. Half of the time, they like to side with their own people. Sometimes it may require filing a Civil Remedy Notice to the governing agency. For example, in Florida the governing agency overseeing insurance related matters is the Department of Financial Services (DFS). If an insurance company is not acting in good faith to work on a claim appropriately and with commitment to the insured, then a complaint can be filed for investigation. A good Public Adjuster will know how and when to navigate these waters. We at VIP Adjusting have had many CRN’s filed for resolution. However, one has to be careful to only file a CRN when it is absolutely needed and all other efforts have failed, otherwise it turns into the boy that cried wolf. So, knowing when the insurance company has truly crossed the line is what matters. You cannot file a CRN just because they haven’t returned your phone call within 48 hours, or you feel like they should have paid your claim by now. No, it’s more for when an insurance company fails to issue a coverage decision within the statutory timeframe without good reason and they don’t indicate any reason to believe they will do so since they have ignored all correspondences. There’s a myriad of reasons, but the point being is they have to violate a statute, policy or an ethical standard etc.

We also had a claim during Hurricane Ian, where the homeowner filed a claim in Miami, because she was missing a few shingles after the storm with some interior damage. The insurance company tried to claim the damage was pre-existing. Luckily, the insured did not own the home for a long time and happened to have a recent inspection report from when she purchased the property. We presented the report and the determination was overturned with the insured getting a full payout. Without us, she said she would not have known what to do.

Pre-Purchase Inspection Report

The homeowner for this house in Miami, Florida, purchased the house in 2017 and had a 4-point inspection done to obtain a mortgage. The image on the left shows the roof with no shingle damage on the February 7, 2017 inspection report.

Post Wind Damage

This roof with wind damage is the same roof as the picture above. It was taken 2 years after the purchase occurred. Wind damaged the home from a named storm event and blew off shingles which caused water intrusion in a few spots inside the dwelling.

The insurance company tried to infer that the damage was pre-existing. So the burden was shifted to the insured to provide evidence that the damage was not pre-existing. A recent inspection report confirming the roof was in good working order with no damage was provided by VIP Adjusting which squashed the insurance company’s ridiculous assertion.

It’s vitally important to keep good records of your home always for just this purpose.

REASON #3: LATE REPORTING

Policies often require “prompt notice”. Some carriers deny if you waited “too long”, even if you reported it as soon as you noticed the damage.

Why they do it: It gives them an easy out, even when delay was reasonable. If the policy stipulates that you have 14 days to report a plumbing leak, and it was determined that the leak was from 6 weeks ago, it’s an easy win for the carrier wherein they can deny the claim pursuant that policy language.

How they do it: Sometimes, when the insurance company field adjusters are inspecting damage, they might hire a forensic hygienist or environmentalist to visit the property. They will take samples of the wet building materials and test microbial growth. If there is a fungus growing in the material that takes 6 weeks to grow, making a decision to deny the claim based upon third party independent analysis that the cause of loss was far beyond the 14 day time limit.

What to do about it: Remind and advise the insurance company that the 14 day time frame does not start from the moment the water caused the damage. It starts from the moment you observed or became aware of the damage. From that moment, you have 14 days to file the claim. We have had claims where the homeowner was hit with a denial letter due to “Late Reporting”. However, we showcased photographs from a text message from their house sitter of when the house sitter found the damage. The text messages are dated and irrefutable. The insurance policy language was written by the insurance company and it’s terms are open for interpretation. However, the States are clear that any ambiguity in policy language shall fall in favor of the insured (homeowner). In this case, it was ambiguous as to what constitutes a “late reporting” and what the “14 day reporting time period” meant.

Denial based upon “Late Reporting”

This denial letter claims the loss occurred 189 days before the “Alleged Date of Loss”. The insurance company established a date of loss by questioning the homeowner in detail. The insurance company found a reason based upon that discussion to establish a date of loss inconsistent to what the homeowner reported.

No one could find the cause of damage, including the insurance company. Finally a leak detection specialist found the source of water damage, which was a “fine mist” hidden inside the wall.

The date of loss is considered the date when it was discovered. The insureds didn’t see any damage inside their dwelling until August, which they then promptly contacted their homeowners insurance company and reported a claim.

REASON #4: “WEAR AND TEAR” or “Maintenance” Exclusions

Insurers love vague language as you have read above. If they can chalk your loss up to neglect, aging, or “lack of maintenance"“, they’ll avoid paying.

Why they do it: Similar to the Late reporting above, It gives them an easy out.

What to do about it: We at VIP Adjusting have handled countless cases of "lack of maintenance” ,“neglect” and “age” denial claims. We will review the policy language and compare your loss to covered perils like “sudden and accidental discharge of water”. Damage caused by a pipe burst or storm should not be brushed off as “wear and tear”. Insurance companies love to do this with roofs all the time. We will then get a roofer to provide an expert opinion if the roof damage was sudden and accidental or if it was in fact wear and tear. If needed, we would also hire an engineer to do the same. Getting experts to weigh in and opine is critical in many cases. This presents an impartial view from a licensed expert on the subject matter. Additionally, we’ll pull historical photographic evidence refuting the claim denial similar to the claim above that had an inspection report.

For an example of “Wear and Tear”, look no further than the denial listed above wherein they cite “Wear and Tear and Maintenance” in conjunction with “Long term repeated seepage/leakage”.

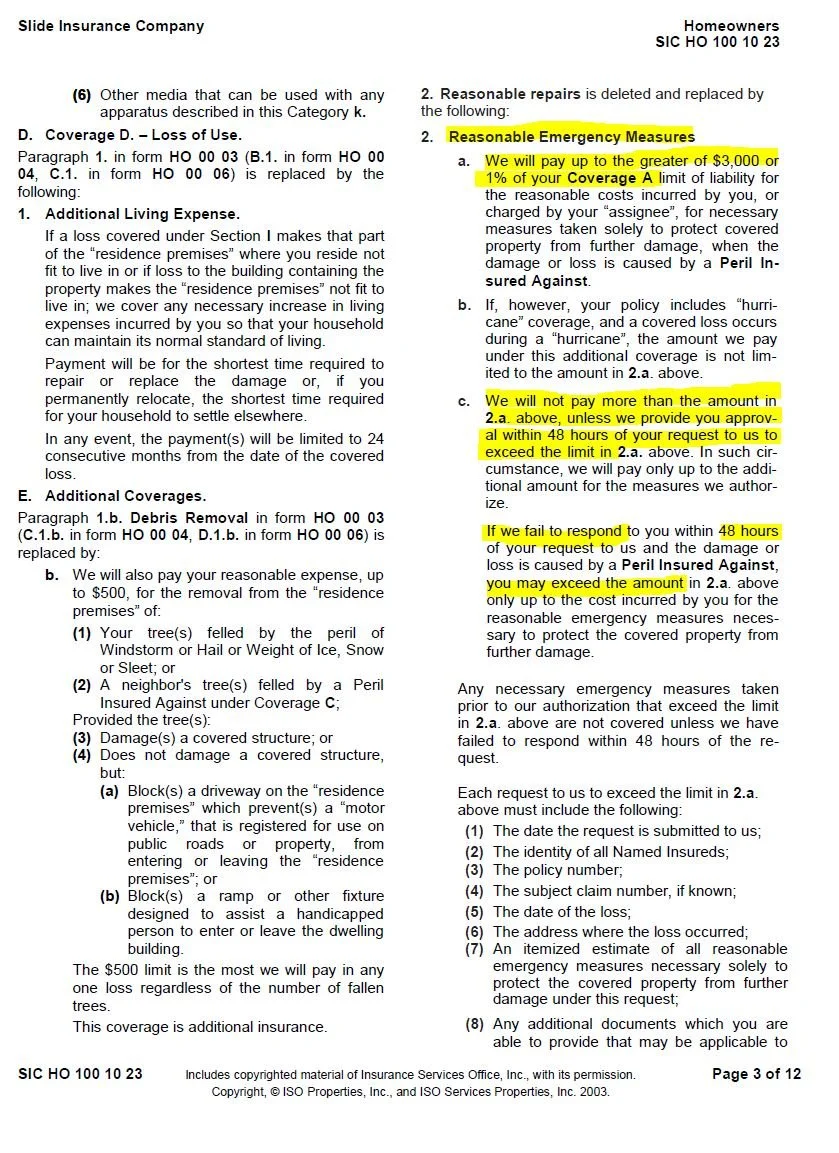

Reason #5: Emergency Mitigation Cap (EMS cap) Misuse

You paid $15,000 to dry out your home after water damage. However the carrier only covers $3,000. Why? The “EMS Cap” in your policy otherwise known as Emergency Services.

Why they do it: The EMS cap is found in the fine print of your insurance policy. You will have to make sure you have the full policy jacket cover to cover. A lot of homeowners only have an abridged version of their policy or just the declarations page. When you have the full policy, you will find a paragraph about Emergency Services. The paragraph will clearly state that the cost of emergency measures to protect your home from further damage are capped at $3,000 or 1% of your coverage A amount.

How they do it: The insurance company conveniently misinterprets the policy language to mean that all dryout / tear out falls under emergency services. When they are served a $15,000 bill for mitigation services, they can easily claim that your homeowners insurance policy clearly states there is a cap. Most homeowners are unaware that this is misdirection and a clear misinterpretation of the policy language. Why pay the 15k bill when they can get away paying 3k. Most homeowner just accept this as it’s written in the insurance policy.

What to do about it: The EMS Cap is to apply only to items or actions required to prevent further damage. For example, a temporary tarp on a roof to prevent further water intrusion, drying out water so it doesn’t cause mold, installing plywood over a window that was blown in. Lumping the entire mitigation or restoration company’s bill into EMS is bad faith claims handling or shows a woefully inadequate in knowledge base on behalf of the insurance company. Typically, only a smaller portion of the mitigation company’s bill falls under EMS. Drying out standing water to prevent mold is an emergency service. Removing the damaged flooring and cabinetry and drywall because it was water damaged is not an EMS item. It’s a good idea to ask the mitigation company to breakdown their bill to showcase what constitutes EMS and what does not. That will clearly delineate the issue on paper instead of months of delay where everyone is interpreting the invoice incorrectly and fighting over it.

We have had many claims where the insurance company attempts to pigeon hole this. However, when we are involved, we attach the issue at the onset. We will write a letter directly to the insurance company department that handles the EMS cap and request to exceed that amount. Typically, they have 48 hours to respond with a yes or no. If they don’t respond, it’s an automatic yes. If they respond with a “no”, then we make sure everything is clear from the onset as to what constitutes EMS. If it is a “yes” then the issue is moot. Read your policy to find the paragraph that speaks to this and the exact contact information to make the request.

Read more about HOMEOWNER Insurance Policies and the $3,000 EMS Cap Explained

Reasonable Emergency Measures - EMS Cap

The excerpt from an insurance company that imposes the 3k EMS Cap is shown to the left. It is often times hard to find for most homeowners and few people are aware of what it actually means.

Insurance companies themselves misapply it to mean “we will only pay up to 3k or 1% of Coverage A for all mitigation costs”. When in fact it is only meant to cover and cap temporary measures to protect yourself from further damage such as a tarp on a roof, plywood over a broken window, drying a sudden water event.

The bulk of a mitigation company’s scope is a part and parcel of the overall construction scope of work. Ripping out damaged drywall is not an EMS item according to the IICRC Standards, which is the book of standards that the industry frequently adheres to.

Reason #6: Mold Exclusion Confusion

Your home has mold after a water leak. However your insurer says it’s excluded

Why they do it: “Mold is excluded” is a common scare tactic. However many policies cover mold when caused by a covered peril, such as a pipe break or storm intrusion.

How they do it: They cite blanket mold exclusions, ignoring key policy exceptions. Or they refuse to recognize mold coverage as distinct from water damage. We are not implying that Insurance companies make this a blanket business practice, moreover it’s often times a bad call by the adjuster working for the insurance company.

What to do about it: Parse your policy line by line. Most policies allow up to $10,000 for mold when it’s the result of a covered peril. We document this relationship and file it under the correct coverage bucket. When necessary, we obtain environmental reports showing mold originated from covered events. Thereby overturning the carrier’s determination with independent third party testing and protocols. The third party mold testing is critical. It’s not enough to state “I have mold in my house, look at the photo”. You have to get a mold report, which comes after doing some field swabs, air testing, etc. by a licensed mold tester. They will send the samples to a lab which will produce a report of exactly the kinds of mold and the saturation level.

The following photos are damage from a flood event with subsequent mold growth

REASON #7: FLOOD VS. WATER DAMAGE MIX-UP

Imagine calling the insurance company because the pipe under your sink burst while you were out shopping and you come home to an inch of water in your house. You call the insurance company and tell them your home was “flooded”. They advise that flood is not covered and hang up. They issue a denial letter, case closed?

Why they do it: Flooding (rising water from outside) is excluded under standard homeowners policies. If your damage is categorized as flood, the carrier isn’t on the hook, unless you have separate flood insurance.

How they do it: They call your loss flood sometimes, even if you don’t. We have seen them determine that the damage to your floors is from “seepage” from the exterior which is also not covered unless something damaged the exterior to cause the seepage. Whether the reason insurance companies do this is bad faith, unintentional, or a mistake is not the case here. The fact is, we have witnessed firsthand that it happens alot.

What to do about it: Reviewing and documenting the actual cause of loss is critical. If water entered through a damaged roof, broken window, burst pipe, then it’s not flood. You would want a picture perfect photo of the cause of loss that is irrefutable. Never use the common term “my house was flooded with water” unless it was in fact flooded by tidal waters from an exterior water source such as a lake, river, stream, pond, ocean, intracoastal waterway, lagoon etc. Instead, you use the terminology precisely what it is “my pipe burst and there is water damage to my dwelling”. People love to say “my place was flooded”, and insurance companies love to take liberties.

Read more about: Back up, overflow, leak, or flood: What's the difference

Flood insurance claim Denial

This insured had a roof leak in Port St Lucie, Fl. There was no flood in the area. We provided proof there was no flood and stuck to our guns. The letter to the left showcases an “overturn” of the insurance company’s flood determination. However, they conveniently pivot and call the damage wind driven rain despite there being roof damage from a wind event and an engineering report proving so.

You can see even one paragraph down where the insurance company left the cause of loss as flood and denial of such in their letter.

It’s a blatant case of bad faith claims handling.

Reason #8: Ignoring the Matching Clause

Imagine having a damaged roof and your roofer says they cannot match the existing material so they recommend full roof replacement. However, the insurance company claims they will only pay 3k to fix the roof because they believe the whole roof doesn’t need to be replaced because it can be matched.

Why they do it: Historically, in many places (especially in Florida), the building code required matching as a category for purposes of insurance. Insurance companies have ignored this or have offered patchwork and matching caps to marginalize their loss.

How they do it: They offer to replace only the damaged portion because the claim it can be matched. They also argue that aesthetic damage isn’t their problem per policy.

What to do about it: In some states such as Florida, there is an organization called “Itel”.

They have access to an inventory of materials and can research if a product is still manufactured in like, kind and quality. If you send them a sample, they will produce a report and advise if the product can be matched. If Itel claims the item connot be matched, then we present that to the insurance company with a demand for the full replacement of the item(s) to achieve a uniform continuous look. Some states such as South Carolina do not have a matching rule. It’s important to have a Public Adjuster that not only understands homeowners insurance policies, but also understand statutes and building code. We at VIP Adjusting have Contractors, Engineers, Environmentalist, and Public Adjusters on staff that fully understand all aspects of building code, statutes and policies. We are also licensed in multiple states and can advise if you live in a “matching” state.

Read more about the 1% matching clause here: Hurricane damaged roofs and the 1% matching clause: what property managers need to know

Reason #9: “Non-Cooperation” Excuses

After spending 60 days waiting for a coverage determination on your claim, you go to the mailbox and find a letter from the insurance company that states “We have denied your claim because you did not provide us information we requested to investigate your loss”. Another insurance claim denial.

Why they do it: Insurers may allege that you failed to cooperate with their investigation. This gives them grounds to stall, delay, or deny your claim.

How they do it: They claim you didn’t provide requested documents, didn’t show up for an inspection, or failed to mitigate damage, whether true or not.

What to do about it: It’s important to document every single thing submitted to the insurance company so you can respond with proof. We at VIP Adjusting manage all communications with the insurer, insured, contractor, engineer, etc., on a claim to ensure you are compliant with policy duties after loss. We have software and a document management system that houses all documentation and correspondences for your claim and we easily respond to those denials that the insured did in fact comply with duties after loss and or provided anything and everything requested.

Read more about Insurance company delays with Boilerplate Document Requests

Non-Cooperation Excuses

The letter to the left showcases a typical insurance denial wherein they try the “non-cooperation” route. However, Each one of the bullet points listed were complied with and submitted prior to the letter. Nonetheless, they doubled down and kept trying to escape coverage. Interesting enough, the loss to this unit stemmed from the very first photo in this article (see roof damage photos at top of article)

REason #10: Lowball Estimates and Over-Depreciation

You have a loss, the insurance company has accepted coverage, but you are wondering why you only have a fraction of what you need from the insurance company.

Why they do it: Why write an estimate to pay you 100k when they can do the same and pay you 10k? If they can’t deny the claim, they will minimize it. Insurers use obscure depreciation tables to devalue your items. They will also not write a proper estimate to treat the damage to keep the value low.

How they do it: They apply excessive depreciation, understate material costs, and exclude standard labor components. They may omit code upgrades or use pricing that is out of touch for your area.

What to do about it: For an average homeowner, it is extremely difficult to combat this. The best you can do is get a contractor to give you an estimate to repair or replace everything back to pre-loss conditions ( no upgrades, you are replacing like materials for like materials in the same layout). We as Public Adjusters generate line by line Xactimate estimates that reflect real, local market pricing. Insurance companies typically use the same software, however it’s the user that makes all the difference. The carriers routinely utilize the software to write very low estimates. We write estimates of what we expect the cost to restore to pre-loss conditions.

Read more about depreciation here: ACV vs. RCV in homeowners insurance claims

Other articles of interest:

What does my Homeowners Insurance Cover? How to get paid for damage?

Call: 833-WITH-VIP (833-948-4847)