8 Things to Look For in Your Homeowners Insurance Policy

A few months ago, we wrote a short article “Top 7 Things to Look for in a Homeowners Insurance Policy” . This article, with “8 Things to Look For…” goes in further depth on each segment along with an additional item to look out for.

NOTE: It’s important to understand that it is incredibly difficult to get a policy that checks all the boxes in “Things to Look For”. However, if the majority of “boxes” are checked, or at least the most important ones, then it’s a good idea to consider the policy for your dwelling. When asked, we typically draw a hardline where the following things are a must if you want a decent policy:

Has an Appraisal clause,

No Water Caps,

No 1% matching endorsements.

When disaster strikes, your homeowners insurance policy becomes the one document that can protect or destroy your financial future. Yet, most homeowners never actually read their policy, and if they do, they rarely know what to look for.

As experienced public adjusters handling thousands of claims across Florida, South Carolina, Louisiana, Texas and Colorado, we’ve seen firsthand how the right or wrong policy language can make or break a claim. Here's a detailed breakdown of the 8 most important things to look for in your homeowners insurance policy.

1. Appraisal Clause — Your Right to a Fair Settlement

If you and your insurance company disagree about how much your loss is worth, the appraisal clause gives you a contractual right to resolve that disagreement without going to court. It empowers each party to select an appraiser, with a neutral umpire breaking the tie.

Avoid policies that require both parties to agree before initiating appraisal or those that omit the clause altogether. Ask your agent directly: “Is there an appraisal clause in my policy, and can I invoke it independently?”

Understanding the Appraisal Process in Insurance Claims: Click here to see a helpful video on the appraisal process

When your insurance company refuses to pay what your claim is truly worth, the appraisal process can be one of the fastest and most effective ways to resolve the dispute—without filing a lawsuit.

Appraisal exists as a built‑in policy provision designed to settle disagreements over the amount of loss, not coverage itself. It provides an impartial, legally binding way to determine how much the insurance company should pay to repair or replace the damage.

What Is Appraisal?

Appraisal Panel:

Your appraiser represents your interests and evaluates the full scope of damage.

The insurance company’s appraiser represents the carrier’s view of the loss.

The umpire acts like a neutral judge and only steps in if the two appraisers can’t agree.

Appraisal is a formal dispute resolution process written into most property insurance policies. It’s somewhat similar to arbitration or mediation—but faster and typically less expensive. The appraisal clause allows both you (the insured) and the insurance company to hire independent professionals, called appraisers, who then select a neutral umpire to resolve any differences.

Think of it as a mini‑courtroom for insurance disputes, except instead of attorneys and judges, you have construction and insurance experts deciding what the loss is truly worth.

Your appraiser represents your interests and evaluates the full scope of damage.

The insurance company’s appraiser represents the carrier’s view of the loss.

The umpire acts like a neutral judge and only steps in if the two appraisers can’t agree.

Once two of the three (either both appraisers or one appraiser and the umpire) agree on the value, that number becomes final and binding—meaning the insurance company must issue payment for that amount (assuming there is coverage, for example: Some appraisal panels will apply a value for screened enclosure damage whereas the policy does not provide coverage for it - The carrier will then rightfully remove that value out of the equation)

Why Choose Appraisal?

Appraisal was created as an alternative to litigation, offering a faster and less confrontational path to resolution. In Florida, the process was designed to ease the burden on the court system and give policyholders a fair way to settle disputes without the delays of a lawsuit.

When a carrier refuses to re‑inspect, won’t negotiate, or stalls endlessly, appraisal can bring closure in weeks instead of years. Most carriers must name their appraiser within 20 days of invocation, and once the appraisal award is signed, the insurance company typically issues payment within 30 days.

What Appraisal Covers

Appraisal can be used for nearly every type of property claim dispute, including:

Dwelling (Coverage A) – The structure itself

Other Structures (Coverage B) – Sheds, fences, pool cages, etc.

Contents (Coverage C) - Furniture, Electronics, Clothing etc.

Loss of Use / Additional Living Expenses (Coverage D) - If you have to rent another place because you lost the use of your dwelling / Eating out due to no kitchen, etc.

Mitigation and Emergency Services (EMS) – Dry‑out, mold remediation, tarps, etc.

In some cases, Ordinance & Law upgrades

Sometimes, the appraisal panel may choose to leave portions like Additional Living Expenses (Coverage D) or mold coverage open such that the homeowner can recover those funds in an ongoing basis. Otherwise, if the panel provides a value and closes out the coverage, then should the homeowner incur additional expenses, it wouldn’t be covered. It’s nota bad thing to leave some coverages open. Typically however, we like to see everything handled at once in the appraisal process if possible.

Pros and Cons of Appraisal

Pros:

✅ Faster resolution than litigation (usually 30–60 days)

✅ Legally binding award—no endless appeals

✅ Less expensive than hiring an attorney

✅ Conducted by experienced industry professionals

Cons:

⚠️ You must pay your appraiser and half the umpire’s fee (often $1,500–$2,000 each)

⚠️ If the award isn’t in your favor, it’s still binding and difficult to appeal

⚠️ It only determines amount of loss, not coverage disputes

At VIP Adjusting, we’ve handled numerous appraisals with excellent outcomes for our clients. In some cases, if the insurance company allows us to act as your appraiser directly, there is no additional appraisal fee at all, since our retainer already covers our representation.

When to Invoke Appraisal

Appraisal is most beneficial when:

The insurance company has accepted coverage but undervalued the claim.

Negotiations have stalled or gone silent.

You’ve provided all documentation and the carrier still refuses to pay fairly.

In contrast, if your claim was fully denied on coverage, appraisal may not apply; litigation could be necessary instead.

Appraisal is one of the most powerful tools available to homeowners and business owners facing an insurance dispute. It’s faster, more predictable, and often more successful than going straight to court.

If you’re stuck in a stalemate with your carrier—or if your payout seems suspiciously low—VIP Adjusting can help determine whether invoking appraisal is the right move for your situation.

2. No Water Damage Cap — Hidden Limits That Cost You Thousands

No Water Damage Cap – Hidden Limits That Could Cost You Thousands

Water damage from a burst pipe or roof leak can cost tens of thousands to repair. Yet many policies cap water damage at just $10,000.

Watch for endorsements like HO 23 85 FL, which limit coverage. Request a quote for full water damage coverage under Coverage A (Dwelling).

One of the most dangerous hidden pitfalls in a homeowners insurance policy is the water damage cap—a fine-print clause that can slash your claim payout by tens (or even hundreds) of thousands of dollars. Most policyholders and Insurance Agents don’t even know it’s there—until it’s too late.

What Is a Water Damage Cap?

Water Damage Cap at 10% Cov. A?

“A water damage cap is a limitation—usually $10,000—on how much your policy will pay for non-weather-related water damage. This cap applies to sudden and accidental losses like:

Pipe bursts

Appliance overflows

Supply line leaks

Shower or tub backups

AC line condensation overflows”

A water damage cap is a limitation—usually $10,000—on how much your policy will pay for non-weather-related water damage. This cap applies to sudden and accidental losses like:

Pipe bursts

Appliance overflows

Supply line leaks

Shower or tub backups

AC line condensation overflows

These are among the most common causes of home insurance claims—yet policies with this cap will only pay a maximum of $10,000 no matter how bad the damage is.

Why This Cap Is So Problematic

In today’s market, $10,000 barely scratches the surface of a major water loss. If a leak travels under flooring and walls or damages built-in cabinetry, you could easily be looking at $50,000 to $200,000 in actual repair costs.

Worse, the cap applies across the entire claim, not per item. That means the damage to your floors, walls, cabinets, contents, and even emergency mitigation is all lumped into the same $10,000 limit.

Real-World Example: The $200,000 Loss That Paid Out $10,000

Let’s say a homeowner in Jupiter, FL, comes home to find a pipe has burst in their kitchen while they were at work. Water ran for several hours, soaking:

Hardwood floors throughout the open-plan home (living room, dining, hallways, bedrooms)

Baseboards in nearly every room

Kitchen cabinets, which absorbed water from underneath

Drywall and insulation in affected walls

Furniture and electronics

The water mitigation company quotes $15,000 just for dry-out and mold prevention. The general contractor estimates $185,000 for demolition, flooring replacement, cabinetry, trim, drywall, painting, and rebuild.

Total estimated loss? $200,000.

But the policy has a $10,000 water damage cap hidden in an endorsement the homeowner didn’t fully understand when they bought the policy. Their insurance company says:

“We’re sorry, but water damage coverage is limited to $10,000 for this type of loss.”

Suddenly, the entire policy—which the homeowner paid $4,000 per year for—feels almost worthless.

The Cost to Avoid This Mistake Is Nominal

Here’s the kicker: Policies without a water damage cap typically cost just a few hundred dollars more per year. For a modest premium increase, you can secure full Coverage A protection for water damage—allowing the carrier to pay what’s actually owed based on the damage, not an arbitrary cap.

Always ask your agent or broker the following:

“Does this policy cap water damage at $10,000?”

“Can I remove that cap or increase the limit to match my Coverage A?”

“Is HO 23 85 or a similar water cap endorsement attached to this policy?”

What to Watch For in Your Policy

Look closely for language like:

"Water damage resulting from sudden and accidental discharge is limited to $10,000."

Or for endorsements with codes like HO 23 85 FL or HO 23 41, which impose water damage limits.

If these are included, you’re not fully protected—even if your home is worth $500,000 or more.

Final Word: Get Full Coverage Now—Not After the Leak

Water losses are frequent, fast-moving, and expensive. They don’t discriminate between homeowners with great policies and those with hidden caps. The difference is only revealed when it’s time to file a claim—and by then, it’s too late to fix.

At VIP Adjusting, we help policyholders fight for full payment—and we always recommend choosing policies with no water damage cap if it can be avoided.

Need help understanding your policy before it’s put to the test? Call us for a free policy review and let us make sure you’re not stuck with a $10,000 cap on a $200,000 problem.

3. No 1% Matching Clause — Protect Your Home’s Uniform Appearance

Roof Damage and the 1% clause:

With damage like this, a 1% matching clause can severely impact your recovery, to the point where the policy is almost worthless when you take the deductible into account, especially on large losses such as this claim we worked on.

If your roof, flooring, or siding is partially damaged, insurers sometimes only pay to replace the damaged portion. The 1% matching clause limits how much they’ll pay to match undamaged items.

Avoid endorsements like HO 17 32. Insist on a policy that pays to restore your home to a uniform appearance.

A “matching clause” is a policy provision that limits how much your insurer will pay when damaged materials (like roofing, siding, flooring, cabinetry) cannot be replaced with an identical manufacturer, color, or style. Often, a clause will cap matching reimbursement to 1% of Coverage A per item, or 3% per loss, hence the “1% matching clause.”

Why this matters

Imagine a large condominium building or a sizable home in Florida is struck by a hurricane. The roof suffers significant damage. The carrier says “we’ll patch it, we won’t replace the whole roof,” because the policy includes a 1% matching clause. If Coverage A is $1 million, 1% is $10,000. Yet a full roof replacement might cost $100,000 or more. You wind up with a cheap patch, mismatched tiles, compromised performance, and future liability for failing materials. The insurer pays only under that 1% clause while everything else may be bypassed or written as a “covered expense” minus matching considerations.

Further complicating things: If adjacent materials must be replaced or upgraded to meet code, if the materials are discontinued, or if a “uniform appearance” rule kicks in under Florida statutes (e.g., §626.9744(2)), the insurer may still owe more—but often tries to hide behind that 1% limit. Without early public adjuster intervention, you may lose out on full replacement rights.

What to inspect in your policy

Does the declarations page or endorsements include any reference to “matching limitation,” “1% of Coverage A,” “HO 17 32 endorsement,” or similar language?

Is there a separate section discussing uniform appearance, or the requirement that replacement materials be “reasonably identical in color, size and quality”?

Does the policy allow the insurer to patch damage and avoid full replacement by citing that your materials can be matched (even if they are discontinued or mismatched)?

Does your roof or affected material fall under a building code trigger (for instance, for some states, if more than 25% of the roof section is damaged, the code may require full replacement regardless of matching clause)?

Are you required to accept managed repair or vendor choices by the insurer that limit your ability to demand full restoration?

What you should do

Before a loss (or immediately after):

Ask your agent: “Is there a matching limitation in my policy? What percentage of Coverage A does it allow for matching?”

Review any endorsement codes like “HO 17 32,” “Matching Limitation Endorsement,” or “Matching Clause 1%” and compare the coverage with stated value of your property.

In the event of damage: Call a public adjuster early. Have your adjuster procure a detailed estimate from a qualified contractor that documents discontinuation of materials, code upgrade, full section replacement triggers, warranty implications—then present that to the insurer so the matching clause cannot be misapplied.

If you are a property manager or representing an association: Ensure your master policy doesn’t rely solely on matching clause logic. Verify whether full replacement is triggered due to material obsolescence, building code upgrade, or scope exceeding patch capability.

Real‑world example

A multi‑unit residential building sustained roof damage in a hurricane. The policy had a 1% matching clause—with a Coverage A of $8 million, the matching cap was just $80,000. The full replacement cost was over $700,000. The insurer attempted to apply that $80,000 cap and only repair portions of the roof. Meanwhile, the building code (pre‑2007 roof) required section‑wide replacement if over 25% of the roof area is damaged. A mismatched patch also risked voiding manufacturer warranties and compromised wind resistance. Ultimately it became a legal, code and scope issue—not simply “did we match the tile?” Without a public adjuster, the owner would have been stuck with a patch job, mismatched materials, future liability, and a partial payout far below what a full restoration would cost.

Bottom line:

When you see a matching limitation clause (for example 1%), don’t assume you’re safe. That clause potentially opens the door for your insurer to avoid paying full replacement just because they claim “we can match it.” In a storm‑prone environment like Florida, where materials age quickly, codes update frequently, and storm risk is high, the difference between a patch and full replacement can be hundreds of thousands of dollars.

Protect your property by demanding full replacement rights when matching is impossible or impractical—and call a qualified public adjuster when you’re facing a matching clause battle.

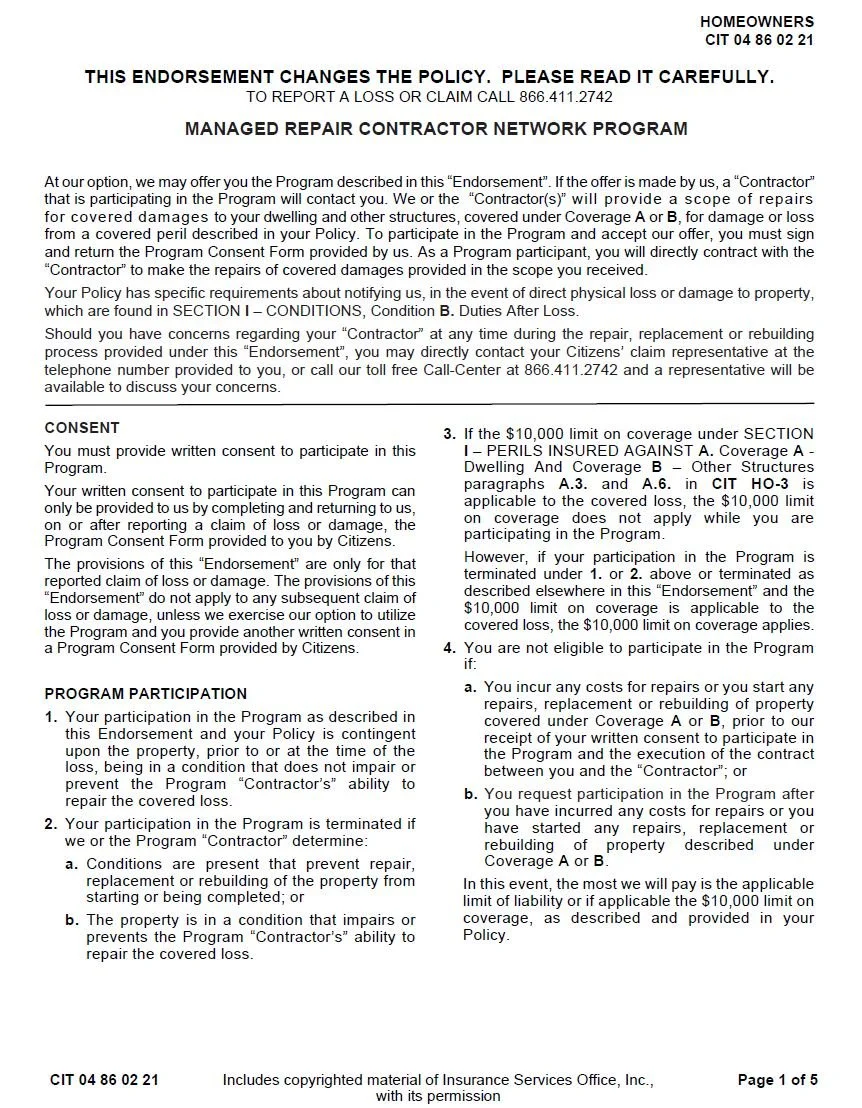

4. No Managed Repair Program (MRP) — Keep Control of Your Property

Managed Repair Program

The snippet to the left is from a Citizens Policy in The State of Florida. It’s and endorsement that changes the policy irrespective of anything stated within the policy. Endorsements replace any prior language in the policy regarding the subject material. Sometimes, having this endorsement is unavoidable.

Some insurance policies contain Right to Repair or Managed Repair clauses that allow the carrier to choose the contractors. This takes the power out of your hands.

Look out for clauses like CIT HO RRC. Reject policies with MRP clauses and maintain control over your repair process.

A “Managed Repair Program” (sometimes called a “right-to-repair” clause) is a policy provision that allows the insurance company to control the repair process: selecting the contractor, defining the scope, sometimes limiting your involvement. While this may sound convenient, it often cuts policyholders out of choice, quality control, and full recovery.

Why it matters: After a covered loss, you might expect to pick your trusted contractor, negotiate terms, ensure quality materials and warranty. Under MRP, the insurer funnels the job through its approved vendor network. That vendor may have incentives aligned with the carrier, possibly reducing cost rather than maximizing your restoration.

What to look for: Check if your policy contains endorsements like “Managed Repair Contractor Network,” “Option to Repair by Insurer,” or clauses giving the insurer the “exclusive right” to select your contractor.

What to do: Insist on a policy that gives you choice of contractor and does not restrict you to the insurer’s network. If your existing policy has an MRP clause, keep detailed documentation of all decisions and consult a public adjuster if you feel the third‑party vendor is compromising your interests. In fact, we have worked on many “Managed Repair Programs” wherein we are monitoring scope of work and make sure that the preferred vendor isn’t cutting corners.

5. Screened Enclosure Coverage — Don’t Let Your Pool Cage Get Left Out

Screened Enclosure - Pool Cage:

In Florida, screened enclosures are common—but many policies exclude them or cap coverage at a fraction of the replacement cost.

Confirm your policy includes hurricane and wind coverage for screened enclosures. Ask: “Is my pool cage fully covered for hurricane or wind damage?”

In Florida, screened enclosures are common—but many policies exclude them or cap coverage at a fraction of the replacement cost.

Confirm your policy includes hurricane and wind coverage for screened enclosures. Ask: “Is my pool cage fully covered for hurricane or wind damage?”

In Florida, screened enclosures (pool cages, lanais, screened patios) are structural elements exposed to hurricanes, wind‑driven rain, and impact damage. Yet many policies either exclude them or drastically limit coverage unless specifically endorsed.

Why it matters: Imagine a hurricane blows off your screened enclosure roof, the whole structure collapses and water damage floods adjacent living spaces. The repair could cost tens of thousands—yet if your policy excludes or caps the enclosure, you may absorb the cost yourself.

What to look for: Verify that your declarations page or policy endorsements include “wind‑storm and hurricane coverage for screened enclosures” and that there is no exclusion for “screened patios” or “screen enclosures.”

What to do: Ask your agent: “Is my screened enclosure covered for hurricane and wind damage? Is it defined as an ‘Other Structure’ under Coverage B or part of the dwelling under Coverage A?” If uncertain, obtain a quote to add specific coverage for screened enclosures.

6. Full Replacement Cost for Roof (Not ACV)

Actual Cash Value (ACV)

Policies that pay only Actual Cash Value (ACV) for roof damage consider depreciation. You may get a fraction of the cost to replace your roof.

Avoid policies that default to ACV. Confirm with your agent: “Is my roof covered at full replacement cost, or ACV?”

Policies that pay only Actual Cash Value (ACV) for roof damage consider depreciation. You may get a fraction of the cost to replace your roof.

Avoid policies that default to ACV. Confirm with your agent: “Is my roof covered at full replacement cost, or ACV?”

Roof damage is a common claim trigger in hurricane‑prone states like Florida. If your policy pays only “Actual Cash Value” (ACV) for your roof, you essentially get depreciated value, which can leave you responsible for thousands more. On the other hand, “Replacement Cost Value” (RCV) pays the cost to replace the roof (or to restore it) without depreciation (subject to policy limits).

Why it matters: Suppose your roof is 12 years old when a windstorm causes major damage. Under ACV, the insurer may deduct 50% depreciation and cut your check accordingly—even if the replacement cost remains high. That leaves you with a contribution or under‑repair situation.

What to look for: Ensure the policy states “Replacement Cost Value (RCV) for roof repairs” and does not convert to ACV when the roof reaches a certain age (common in older policies).

What to do: Have your agent confirm: “If my roof suffers a covered peril, will I be paid RCV regardless of age, or will it convert to ACV after X years?” If you’re offered ACV terms, negotiate a policy upgrade—even if the premium is slightly higher.

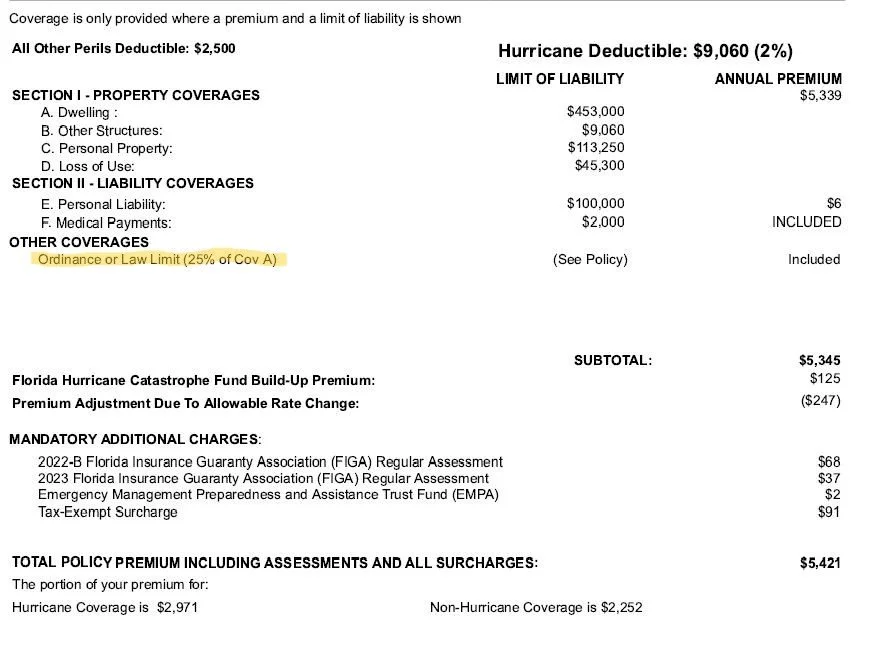

7. Ordinance or Law Coverage — Required Code Upgrades

Ordinance or Law

After a loss, local building codes may require costly upgrades. Without Ordinance or Law coverage, these code-related costs may be entirely out of pocket.

A good policy provides 25–50% of Coverage A for code upgrades. Review your declaration page and increase this if needed.

Why it matters: You may think your policy covers the structural damage—but the cost to bring the property up to current code could be 25–50% extra of your original rebuild. If your policy only offers a 10% ordinance coverage or none at all, you’re vulnerable to massive out‑of‑pocket expenses.

What to look for: A policy with “Ordinance or Law Coverage” of at least 25–50% of Coverage A is ideal. Avoid policies where the wording caps upgrades at low percentages or excludes them entirely.

What to do: Inquire: “My property is located in a hurricane zone with frequent code updates—what ordinance coverage am I afforded?” And ensure you document code‑upgrade obligations (e.g., re‑roofing wind uplift requirements, upgrading hurricane straps, upgrading electrical panel etc.) in your renewal process.

8. Avoid High Hurricane Deductibles — The Silent Budget Killer

A 5% hurricane deductible on a $500,000 policy means you pay $25,000 out of pocket before the carrier pays a dime.

Aim for a flat-dollar deductible or 1% hurricane deductible. A cheaper premium today may mean a massive bill tomorrow.

Hurricane deductibles are often expressed as a percentage of Coverage A (commonly 2%, 5%). For example, on a $500,000 dwelling policy, a 5% deductible means you pay $25,000 out of pocket before the insurer pays anything.

Why it matters: After a major hurricane, many homeowners wrongly assumed their deductible would be manageable—only to learn they must cover tens of thousands first. The size of your deductible dramatically affects your real recovery.

What to look for: Policies with flat‑dollar hurricane deductibles (e.g., $5,000) or 1% deductibles are far more homeowner‑friendly. Avoid policies where the deductible rises with Coverage A or as wind zones change.

What to do: Discuss deductible options with your agent. Ask: “If a Category 4 hurricane damages my home, what will my out‑of‑pocket be under current deductible terms?” Shop for a policy structure that keeps your risk manageable—not just your premium low.

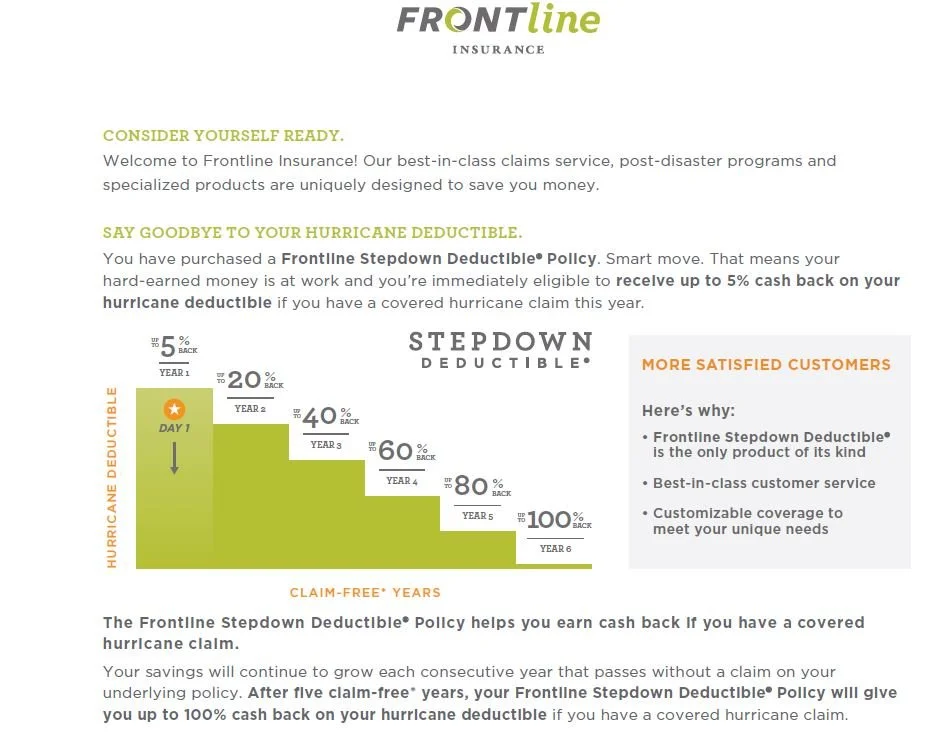

Stepdown Deductible

We don’t necessarily endorse or recommend Frontline over any other insurance company, but the image to the left is an example of a stepdown deductible.

P.S.: Often times, after a significant storm such as a category 5 hurricane, rumors will start to swirl about insurance companies having to forgive the deductible due to the category of storm. This is categorically false. It happens with every major storm. There is not circumstance where your deductible is invalid. However, some policies offer a step down deductible which is nice. That basically means that every year you stay with that carrier, they step down the value of your deductible every year until it reaches zero. A typical timeframe to drop to zero is 5 years. Most policies don’t offer it, however we have seen it utilized with Frontline Insurance for example.

📞 Call VIP Adjusting today at 833-WITH-VIP

📧 Email us at info@vipadjusting.com

You Might Also Like: